Introduction to UBO and BOI

Ultimate Beneficial Ownership (UBO) or Beneficial Ownership Information (BOI) refers to the natural person(s) who ultimately own or control a legal entity, such as a company, trust, or partnership. The Financial Action Task Force (FATF) and Financial Crimes Enforcement Network (FinCEN), a bureau within U.S. Department of Treasury defines a UBO as the individual(s) who ultimately benefit from or exercise control over a legal entity’s operations and assets. Implementing a robust UBO framework is essential for promoting transparency and preventing financial crimes, including money laundering, terrorist financing, and tax evasion. By identifying and verifying UBOs, authorities can trace illicit activities concealed behind complex corporate structures, thereby enhancing the integrity of the global financial system.

Core Benefits

- Regulatory Compliance and Legal Protection: Many jurisdictions mandate UBO disclosure or BOI as part of anti-money laundering (AML), counter-terrorism financing (CTF) and Corporate Transparency Act (CTA) 2021 regulations. Failure to comply can result in hefty fines, legal action, and reputational damage. Adhering to these regulations helps businesses operate within legal frameworks, ensuring smooth regulatory interactions.

- Improved Corporate Governance: Understanding and identifying UBOs or BOIs lead to more responsible corporate governance. Companies with transparent ownership structures are more likely to enforce ethical decision-making, maintain operational integrity, and uphold accountability at all management levels.

- Enhanced Transparency: UBO and BOI frameworks provide a clear view of who ultimately owns or controls a company, ensuring that regulators, investors, and the public have access to crucial ownership information. This transparency helps prevent illicit activities such as fraud, tax evasion, and money laundering while promoting accountability in the corporate sector.

- Stronger Risk Management: Identifying UBOs and BOIs allow businesses to assess potential risks and prevent transactions with entities involved in illegal activities. By conducting thorough due diligence and verifying ownership details, companies can protect themselves from fraud, corruption, and financial crimes that could jeopardize their operations.

- Building Trust and Credibility: Companies that comply with UBO or BOI regulations in United States, demonstrate transparency and ethical business practices, which enhances trust among investors, partners, and customers. This compliance strengthens their reputation and improves business relationships.

Historical Context

The need for Ultimate – Beneficial Ownership – Information (UBO and BOI) regulations arose from major financial scandals and crises, including the Panama Papers leak and the global financial crisis. These events exposed how opaque corporate ownership enables financial crimes like money laundering, tax evasion, and fraud, undermining economic stability. In response, international bodies such as the Financial Action Task Force (FATF) established UBO identification standards to enhance transparency and accountability. Many countries have adopted these regulations to strengthen anti-money laundering (AML) and counter-terrorism financing (CTF) efforts, ensuring a more secure and resilient financial system while preventing illicit activities hidden behind complex corporate structures.

Key Aspects Financial Transparency and Regulation

Corporate Transparency: Ensuring openness and accessibility of ownership and control information helps stakeholders understand who truly operates a business. Transparent corporate structures prevent illicit activities such as fraud and tax evasion while promoting ethical business practices and investor confidence.

Anti-Money Laundering (AML) Compliance: AML laws, regulations, and procedures prevent criminals from concealing illegally obtained funds within the financial system. By enforcing rigorous due diligence, monitoring transactions, and reporting suspicious activities, AML frameworks help combat financial crimes, including money laundering, terrorist financing, and corruption.

🗁 In corporate transparency and AML regulations, “beneficial owner” and “ultimate beneficial owner” (UBO) are often used interchangeably, causing confusion. However, a beneficial owner refers to anyone who enjoys financial benefits, while a UBO specifically identifies the individual with ultimate control over a company or asset, ensuring accountability and regulatory compliance. 👇

Beneficial Ownership Disclosure: A beneficial owner is any individual or entity that gains financial advantages from a company or asset, regardless of the legal titleholder. Identifying beneficial owners is crucial for regulatory compliance, preventing illicit financial activities, and ensuring accountability in corporate structures. Understanding and verifying beneficial ownership strengthens transparency and prevents individuals from hiding behind complex or anonymous business arrangements to conduct unlawful activities.

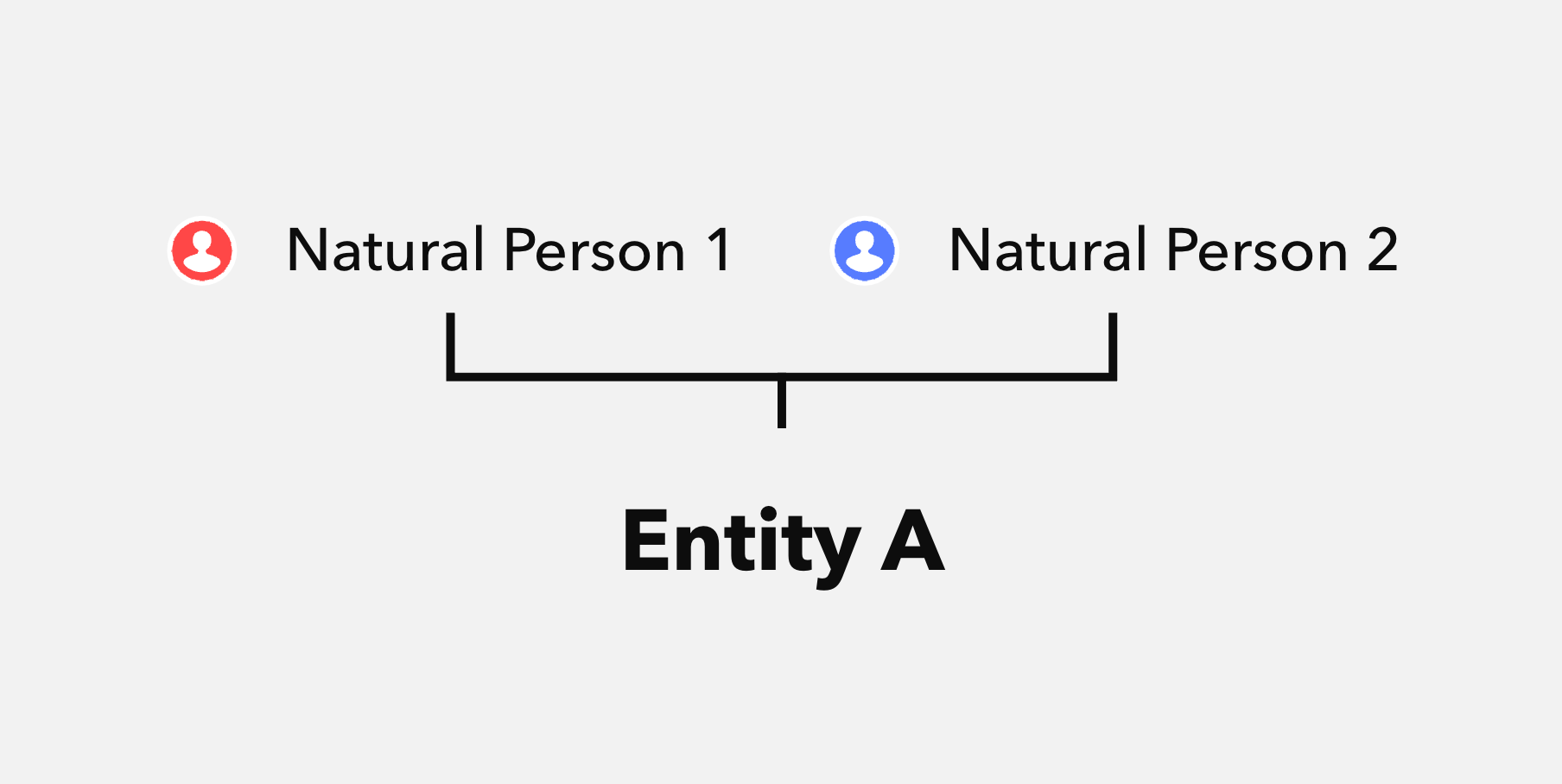

- Natural Person 1 and Natural Person 2 are beneficial owners of Entity A.

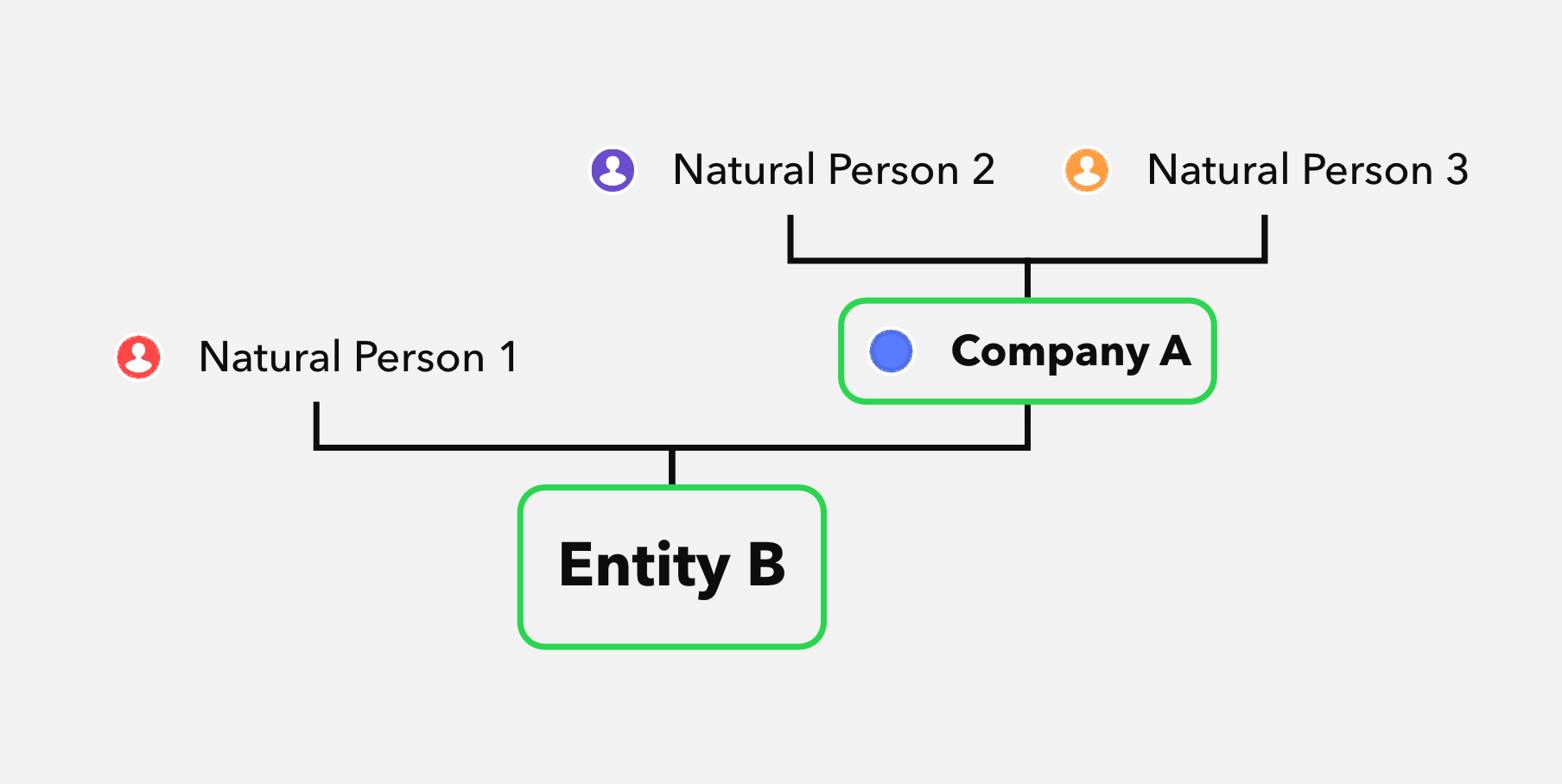

Entities as Beneficial Owners: In the UBO framework, entities like corporations or trusts can be considered beneficial owners if they hold significant ownership or control over another entity. This classification ensures transparency by identifying both individual and corporate interests, preventing misuse of complex structures for illicit financial activities.

Natural Persons 2 and 3 are beneficial owners of Company A

Natural Persons 1-3 are beneficial owners of Entity B

- Natural Person 1 and Company A are beneficial owners of Entity B

- Natural Persons 2 and 3 are beneficial owners of Company A

- Natural Persons 1-3 are beneficial owners of Entity B

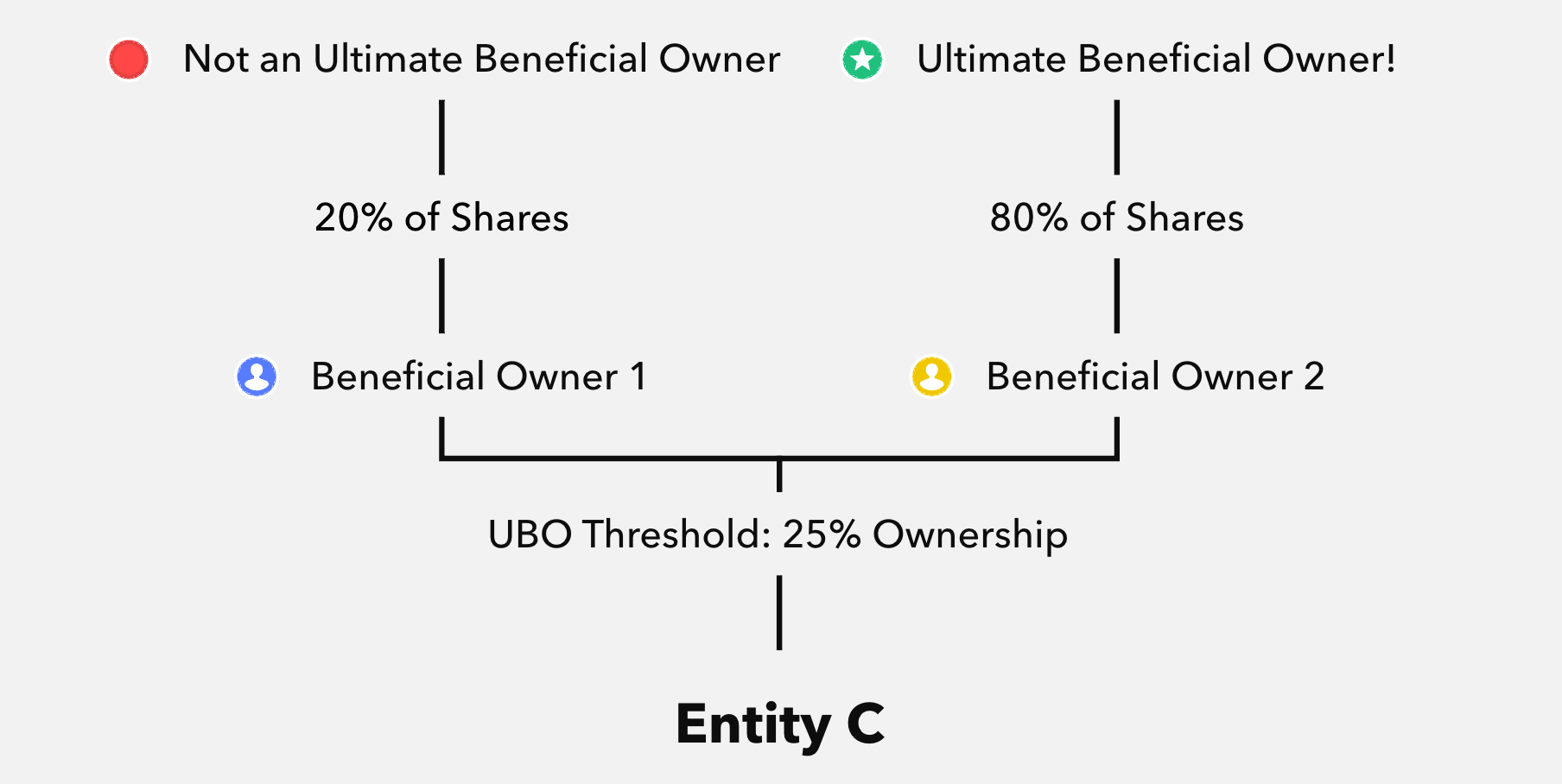

Ultimate Beneficial Owner(s) Information (UBOs and BOIs): Individuals who ultimately own or control an entity based on predefined thresholds within the UBO framework, regardless of legal names or structures on official records. UBOs are often concealed behind complex corporate layers, making transparency crucial for preventing financial crimes like money laundering and tax evasion.

In this simplified UBO framework, the only UBO identification threshold is an ownership percentage of 25%.

- Beneficial Owner 1 does not meet the thresholds for UBO, while Beneficial Owner 2 does!

Beneficial Ownership Information (BOI)

Beneficial Ownership Information (BOI) includes key data on individuals or entities that directly or indirectly own or control a company or organization. It plays a vital role in identifying Ultimate Beneficial Owners (UBOs) among beneficial owners, enabling regulatory bodies and businesses to trace ownership structures effectively. Ultimate Beneficial Ownership Information (UBO or BOI) collection involves analyzing ownership stakes, control mechanisms, and complex corporate hierarchies to uncover hidden relationships. By ensuring transparency, BOI helps prevent financial crimes such as money laundering and fraud while strengthening compliance with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, fostering a more secure and accountable financial system.

Key Components of Beneficial Ownership Information (BOI)

- Identification Data: Includes the full legal name, date of birth, nationality, residential or business address, and a unique identifying number (e.g., passport or driver’s license number) to accurately verify individuals.

- Ownership and Control Details:

- Specifies the nature and extent of ownership interest, such as holding a significant percentage of shares (e.g., more than 25%).

- Identifies individuals with substantial control or influence, including voting rights or contractual agreements that impact decision-making.

- Traces ownership through entities acting as beneficial owners to ensure ultimate beneficial owners (UBOs) are properly identified and documented.

Comparing BOI Reporting Mechanisms: Insights from the United States and European Union

Understanding regional differences in Beneficial Ownership Information (BOI) reporting is crucial for global compliance. The United States and the European Union have established key regulatory frameworks that enhance transparency and combat financial crimes. Their approaches set important precedents, shaping international standards. Comparing the US and EU frameworks provides insights into how different strategies address similar goals while highlighting unique challenges and benefits. These variations underscore the need for harmonized regulations to improve financial security and prevent illicit activities worldwide.

US: Beneficial Ownership Information Report (BOIR)

The Corporate Transparency Act (CTA) requires businesses in the United States to submit a Beneficial Ownership Information Report (BOIR) to enhance corporate transparency and combat financial crimes like money laundering and terrorist financing.

Content: The Beneficial Ownership Information Report (BOIR) includes essential details about a company’s beneficial owners, such as:

- Full legal name

- Date of birth

- Current residential or business address

- Unique identifying number (e.g., passport or driver’s license number)

Process: Companies must file the Beneficial Ownership Information Report (BOIR) upon formation or registration. Any changes in beneficial ownership must be updated within one year to maintain accuracy. This ongoing requirement ensures regulators have up-to-date records to prevent illicit financial activities.

Access: Beneficial Ownership Information Report (BOIR) data is confidential and accessible only to law enforcement agencies and authorized entities. This confidentiality protects beneficial owners’ privacy while enabling effective regulatory oversight.

Penalties: Failure to comply with BOIR requirements can lead to severe consequences of criminal penalties and significant fines of civil penalties. Companies that fail to file or submit false information can face Civil penalties of up to $591 per day for non-compliance, Criminal fines of up to $10,000 and Potential imprisonment for up to two years. These strict penalties emphasize the importance of compliance in strengthening corporate transparency and preventing financial crimes.

EU: Central Register of Beneficial Ownership

The European Union’s 4th and 5th Anti-Money Laundering Directives (AMLD4 and AMLD5) require member countries to establish Central Registers for Beneficial Ownership Information to enhance transparency and combat financial crimes. These registers help identify Ultimate Beneficial Owners, strengthening anti-money laundering (AML) efforts. The 6th Anti-Money Laundering Directive (AMLD6), while introducing stricter criminal penalties, does not impact the existing UBO regulations established under AMLD4 and AMLD5. These directives form part of the EU’s broader strategy to improve corporate transparency, ensure regulatory compliance, and prevent illicit financial activities across its member states, reinforcing accountability in the European financial system.

Content: The information required for these registers generally include:

- Full legal name

- Date of birth

- Nationality

- Country of residence

- Nature and extent of the beneficial interest held.

Process: Entities must report beneficial ownership information to national registers and ensure it remains current. Regular updates are required to reflect ownership or control changes, though the frequency and process vary by member state. Compliance with these requirements enhances transparency and prevents financial crimes.

Access: A key difference between the US system and the EU’s 5th Anti-Money Laundering Directive (AMLD5) is that the EU mandates public access to certain beneficial ownership information. While access can be restricted in cases of fraud risk or security concerns, the directive prioritizes transparency over privacy.

For example, in Luxembourg, access is generally restricted to individuals who can demonstrate a legitimate interest, with some allowances for local journalists under specific conditions. In Germany, legitimate interest must be assessed on a case-by-case basis, often requiring detailed justification, which can delay access. These differences highlight the EU’s balancing act between transparency, privacy rights, and security concerns in financial disclosures.

Penalties: Non-compliance with the European Union’s Anti-Money Laundering Directives (AMLD4, AMLD5, and AMLD6) can lead to substantial penalties, varying by member state but generally including significant fines and other administrative sanctions. These penalties are designed to ensure compliance and deter entities from attempting to obscure their ownership structures.

For instance, under AMLD4, legal entities may face fines up to €5 million or 10% of annual turnover, while natural persons can incur penalties up to €5 million. AMLD6 further harmonizes the definition of money laundering offenses across member states and introduces stricter sanctions, including a minimum of four years’ imprisonment for serious offenses.

Additionally, the newly established Anti-Money Laundering Authority (AMLA) possesses supervisory powers to impose pecuniary sanctions on entities for serious, systematic, or repeated breaches. The maximum financial penalty under AMLA can reach up to 10% of the entity’s previous annual turnover or €10 million, whichever is higher.

These stringent measures underscore the EU’s commitment to enhancing transparency and combating financial crimes by holding entities accountable for non-compliance.

While both the U.S. and EU frameworks seek to enhance transparency and combat financial crimes, they differ in several key areas, including information access, update processes, and penalties for non-compliance. The U.S. system prioritizes confidentiality, ensuring that Beneficial Ownership Information (BOI) is accessible only to regulatory bodies and law enforcement, with strict penalties for violations. In contrast, the EU framework emphasizes public accessibility, allowing broader access to ownership information while imposing member state-specific enforcement mechanisms. Additionally, penalties in the EU vary by country, whereas the U.S. applies uniform federal fines and legal consequences for non-compliance.

Global Perspectives and Comparisons

Building on the comparison of beneficial ownership Information reporting mechanisms between the US and the EU, it is crucial to explore how other regions approach UBO regulations. Different regions have developed unique frameworks to address transparency and combat financial crimes, reflecting their legal, economic and regulatory environments.

United Kingdom

- Regulations: The UK mandates that most incorporated companies and Limited Liability Partnerships (LLPs) maintain a People with Significant Control (PSC) register, detailing individuals or entities with significant control. This information must be filed with Companies House within 14 days of any changes.

- Public Access: The People with Significant Control (PSC) register is publicly accessible, enhancing corporate transparency and accountability by allowing stakeholders, regulators, and the public to identify individuals or entities with significant control over UK companies.

Pacific

- Hong Kong: The Companies (Amendment) Ordinance 2018 mandates that all companies incorporated in Hong Kong, except those listed on the Stock Exchange, maintain a Significant Controllers Register (SCR). This register records individuals or entities with significant control over the company, enhancing transparency of corporate beneficial ownership. The SCR must be kept at the company’s registered office or a prescribed place in Hong Kong and be accessible for inspection by law enforcement officers upon demand. Companies are required to take reasonable steps to identify significant controllers, including reviewing available documents and issuing notices to potential controllers to obtain accurate information. Non-compliance with these requirements can result in criminal offenses, leading to fines up to HK$25,000 and additional daily penalties for continued non-compliance.

- Singapore: The Accounting and Corporate Regulatory Authority (ACRA) mandates that all companies, including foreign companies and Limited Liability Partnerships (LLPs), maintain a Register of Registrable Controllers (RORC). This register records individuals or entities with significant interest or control over the company, enhancing transparency in corporate ownership. Companies must identify their controllers by taking reasonable steps, such as sending notices to potential controllers and others who might have relevant information. The RORC must be established within 30 days of incorporation and kept at the company’s registered office or the address of an authorized filing agent. Additionally, entities are required to lodge the RORC information with ACRA’s central register within two days of setting up or updating the register. Access to the RORC is restricted to law enforcement agencies for regulatory purposes, ensuring confidentiality while promoting compliance. Non-compliance can result in fines up to S$5,000.

- Australia: Australia is actively enhancing its approach to Ultimate Beneficial Ownership (UBO) to bolster corporate transparency and combat financial crimes. The proposed register would require unlisted companies and legal entities to identify and maintain accurate records of their beneficial owners. A beneficial owner is defined as an individual holding at least a 20% ownership interest, aligning with existing Australian corporate control thresholds. Entities would be obligated to verify this information and report it to a centralized, government-operated register. The implementation is planned in phases, initially limiting access to certain stakeholders, with broader public accessibility envisaged in subsequent stages.

These reforms are part of Australia’s commitment to align with international standards set by the Financial Action Task Force (FATF), ensuring that accurate and current beneficial ownership information is readily available to authorities. By increasing transparency, Australia aims to deter illicit activities and promote a more secure financial environment.

Middle East

- United Arab Emirates: Has undertaken significant initiatives to align with the Financial Action Task Force (FATF) standards, particularly concerning Ultimate Beneficial Ownership (UBO) regulations, to combat money laundering and terrorist financing. In 2020, the UAE introduced Cabinet Decision No. (58) of 2020, mandating all legal entities to maintain a Register of Beneficial Owners. This register requires entities to identify individuals holding 25% or more of ownership or voting rights, or those exercising control through other means. Recognizing challenges in complex corporate structures, the UAE issued Cabinet Decision No. (109) of 2022, granting registrars discretionary authority to determine beneficial ownership in intricate arrangements, ensuring transparency even in layered ownership scenarios. The FATF acknowledged the UAE’s efforts by removing it from the “grey list” in February 2024, highlighting the nation’s substantial reforms in its anti-money laundering and counter-terrorist financing framework. In summary, the UAE’s proactive approach in implementing and refining UBO regulations underscores its dedication to combating financial crimes and fostering a transparent business environment.

- Saudi Arabia: Has implemented robust measures to enhance corporate transparency and align with international standards set by the Financial Action Task Force (FATF). Central to these efforts is the Saudi Arabian Monetary Authority (SAMA), which oversees the implementation of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. SAMA has issued comprehensive guidelines mandating financial institutions to identify and verify the identities of their customers and beneficial owners. These guidelines require institutions to obtain and verify information such as full legal names, residential or national addresses, dates and places of birth, and nationalities for natural persons. For legal entities, institutions must obtain details including the name, legal form, proof of existence, and the identities of directors and senior management.

In addition to customer due diligence, SAMA’s regulations emphasize the importance of ongoing monitoring and record-keeping. Financial institutions are required to maintain up-to-date records and ensure that all client and transaction information is readily accessible to authorities upon request. This approach facilitates prompt access to critical information, aiding in the detection and prevention of money laundering and terrorist financing activities.

To modernize its business environment under Vision 2030, Saudi Arabia introduced regulations defining a beneficial owner as any individual holding at least 25% of a company’s capital, controlling 25% or more of its voting rights, or exerting significant influence over its decisions. Companies are now required to disclose beneficial ownership details upon registration and confirm their accuracy annually. Non-compliance can result in penalties up to SAR 5 million (approximately USD 1.3 million) or other sanctions under the Companies Law.

Latin America

- Mexico: Enacted the Federal Law for the Prevention and Identification of Operations with Resources of Illicit Origin (LFPIORPI), aiming to combat money laundering and financial crimes. This legislation mandates that entities identify and report individuals with significant ownership or control, enhancing corporate transparency. The law encompasses various “vulnerable activities,” including financial services, real estate transactions, and the trading of precious metals. Entities involved in these activities must implement robust Know Your Customer (KYC) processes and report suspicious operations to the Financial Intelligence Unit (UIF). Non-compliance can result in substantial penalties, underscoring Mexico’s commitment to aligning with international anti-money laundering standards.

- Brazil: Regulations adopted by the Federal Revenue Service (RFB) in 2016 implemented regulations mandating that companies and financial institutions disclose their Ultimate Beneficial Owners (UBOs). This requirement, established under Normative Instruction RFB No. 1,634/2016, obliges entities to provide UBO information upon registration with the National Register of Legal Entities (CNPJ) and to update this information within 30 days of any ownership changes. Non-compliance can result in suspension of the CNPJ registration, restricting the entity’s ability to conduct financial transactions.

Africa

- South Africa: The General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Act, 2022 amended the Financial Intelligence Centre Act, 2001, refining the definition of beneficial ownership and expanding its application. This legislative change mandates accountable institutions to identify and verify the beneficial owners of clients that are legal persons, trusts, or partnerships. The Financial Intelligence Centre (FIC) has provided guidance through Public Compliance Communication 59, emphasizing the need for institutions to establish ownership and control structures of their clients. Non-compliance with these requirements can result in administrative sanctions, underscoring the importance of adherence to the updated regulations.

- Nigeria: Has implemented UBO regulations under the Companies and Allied Matters Act (CAMA) 2020 to enhance corporate accountability. The Nigerian Corporate Affairs Commission (CAC) requires companies to disclose beneficial ownership details upon incorporation and update records regularly. CAMA mandates that any person who owns at least 5% of shares or exerts significant influence over a company be identified and recorded in the central Ultimate Beneficial Ownership (UBO) register. This initiative aligns with Financial Action Task Force (FATF) recommendations and supports Nigeria’s efforts to combat corruption, tax evasion, and illicit financial flows.

Similarly, the use of anonymous shell companies has facilitated sanctions evasion and corruption. For instance, companies registered in British Overseas Territories exported goods to Russia, breaching UK sanctions. The lack of transparent ownership records in these territories complicated efforts to track and halt these illicit transactions. This example highlights the need for comprehensive UBO frameworks to deter the misuse of corporate entities for unlawful purposes.

These cases demonstrate that without effective UBO regulations, financial systems remain vulnerable to exploitation by malicious actors. Implementing robust UBO frameworks is essential for enhancing transparency, preventing financial crimes, and ensuring compliance with international standards.

Case Studies and Real-World Examples

The Panama Papers:

- Background: In April 2016, the Panama Papers leak unveiled over 11.5 million confidential documents from the Panamanian law firm Mossack Fonseca, exposing a vast network of offshore entities utilized to conceal asset ownership and evade taxes.

- Impact: The revelations prompted global scrutiny of Ultimate Beneficial Ownership (UBO) regulations, leading numerous jurisdictions to strengthen their frameworks to prevent misuse of offshore structures for illicit activities.

- Outcome: Several high-profile individuals and corporations faced legal and financial consequences, underscoring the necessity for robust UBO identification to enhance financial transparency and combat financial crimes.

1MDB Scandal:

- Background: The 1Malaysia Development Berhad (1MDB) scandal involved the misappropriation of billions of dollars from a Malaysian state-owned investment fund. Investigations revealed that over $4.5 billion was diverted from the fund between 2009 and 2014, financing luxury real estate, art, and even Hollywood films. Key figures, including financier Jho Low, utilized complex networks of anonymous shell companies to conceal the true ownership of assets, facilitating large-scale embezzlement and money laundering.

- Role of UBO Identification: The scandal underscored the critical role of Ultimate Beneficial Ownership (UBO) transparency. Hidden UBOs enabled perpetrators to obscure their identities and illicit activities. The lack of robust UBO disclosure requirements allowed individuals like Jho Low to exploit financial systems, demonstrating how anonymity in corporate structures can facilitate corruption and financial crimes.

- Outcome: In response to the scandal, global regulatory bodies and financial institutions have emphasized the importance of UBO transparency. Reforms have been implemented to strengthen UBO identification processes, aiming to prevent similar occurrences in the future. These measures include stricter due diligence requirements and the establishment of public registers to disclose the true owners of companies, enhancing accountability and deterring financial misconduct.

Luanda Leaks:

- Background: The Luanda Leaks exposed a vast network of financial schemes allegedly used by Isabel dos Santos, the daughter of Angola’s former president, to siphon off public wealth for personal gain. In January 2020, the International Consortium of Investigative Journalists (ICIJ) published more than 715,000 leaked documents, revealing how dos Santos and her associates moved vast sums through offshore companies and secretive financial networks. The leaks detailed how she amassed an empire spanning oil, banking, telecommunications, and real estate, often using preferential deals granted while her father was in power. Funds were funneled out of Angola through a complex web of shell companies registered in tax havens such as Dubai, Malta, and Mauritius.

- Role of UBO Identification: The scandal demonstrated how opaque corporate structures allow influential figures to hide true ownership and move illicit funds across borders undetected. The leaks highlighted weaknesses in Ultimate Beneficial Ownership (UBO) regulations, where anonymous shell companies were used to launder money and evade scrutiny. The case reinforced the need for stronger corporate transparency laws and financial oversight to prevent abuse.

- Outcome: Following the revelations, multiple countries initiated legal actions against Isabel dos Santos. Angolan courts froze her assets, and by 2024, she faced additional sanctions, including a $733 million asset freeze upheld by London’s High Court. These developments reinforced the global push for UBO transparency, prompting jurisdictions to enhance regulations and prevent similar abuses. The Luanda Leaks serve as a compelling case for robust UBO identification measures to combat corruption and promote financial integrity.

FIFA Corruption Scandal:

- Background: The U.S. Department of Justice indicted nine FIFA officials and five corporate executives on charges of racketeering, wire fraud, and money laundering conspiracies. Investigations revealed that high-ranking FIFA officials accepted bribes and kickbacks totaling over $150 million in exchange for awarding media and marketing rights to soccer tournaments. These illicit activities were concealed through complex financial arrangements and offshore accounts.

- Role of UBO Identification: Unmasking the ultimate beneficial owners (UBOs) behind these transactions was crucial for authorities to trace illicit funds and hold accountable those responsible. The scandal highlighted how opaque corporate structures can facilitate corruption, emphasizing the need for transparency in ownership to detect and prevent financial crimes.

- Outcome: The revelations led to significant reforms within FIFA, including the implementation of comprehensive due diligence processes for its suppliers. These measures involve compliance screening covering UBOs, sanctions, and bribery concerns, aiming to enhance transparency and restore integrity in sports governance.

What is a UBO or BOI Check?

A UBO check identifies the individuals who ultimately own or control a company by examining its ownership structure and determining the ultimate beneficial owners based on a specific ownership threshold.

Practical Example

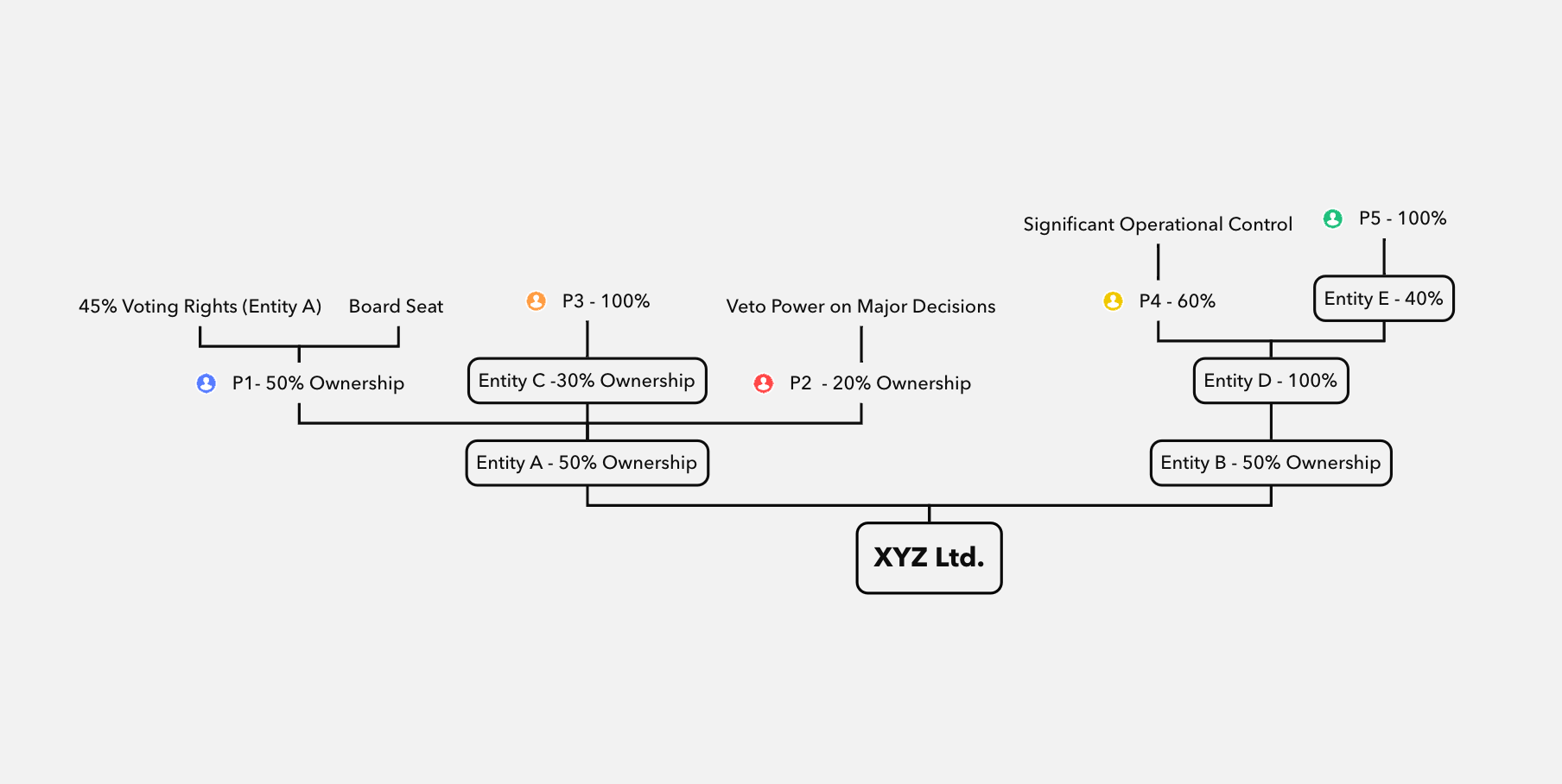

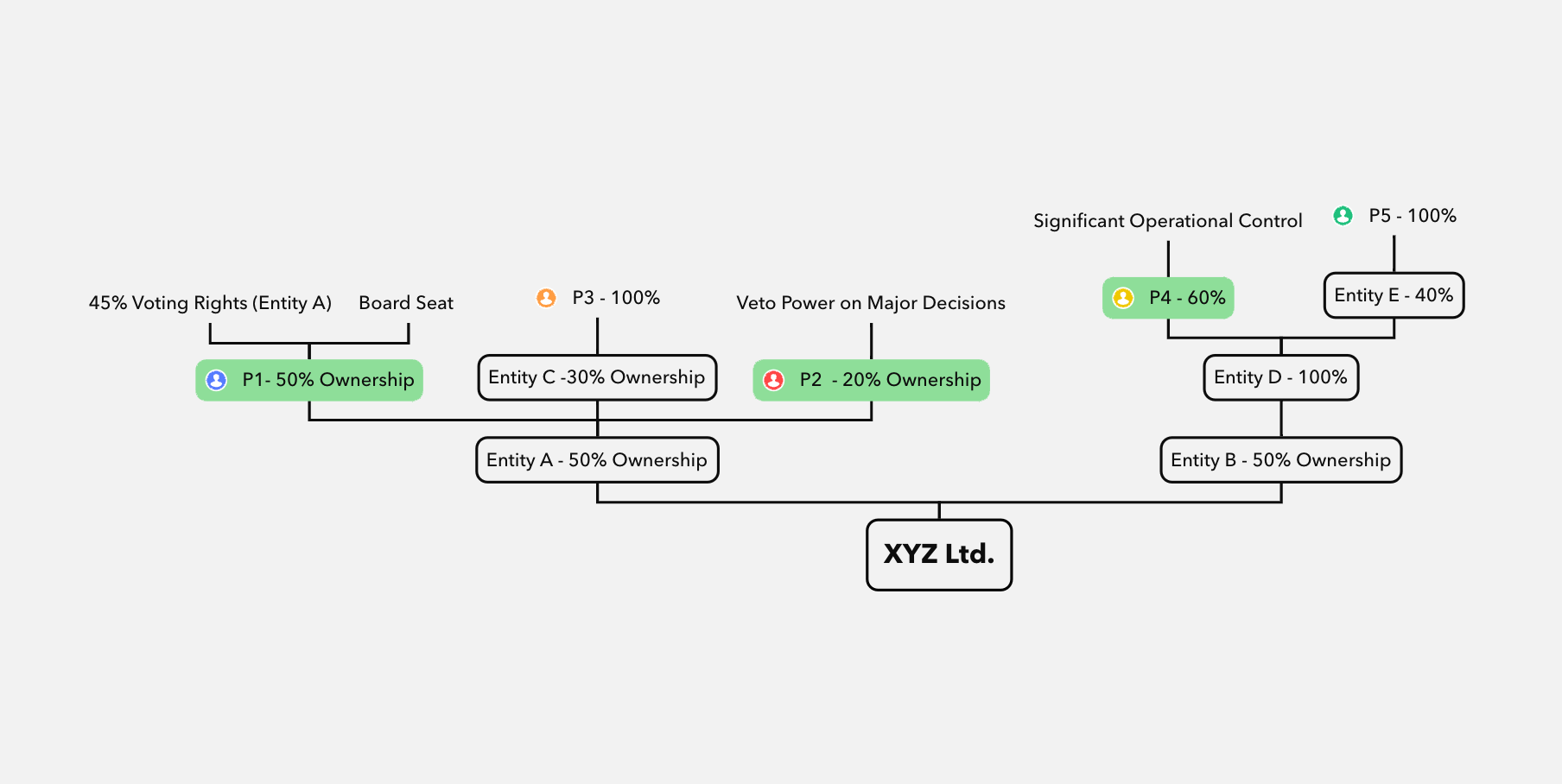

Company Overview: Take XYZ Ltd., a company with multiple ownership layers, where various entities hold stakes, each with its own control structures and ownership mechanisms.

Objective: To engage in business with XYZ Ltd., you must identify the natural persons (beneficial owners) who ultimately control the company by analyzing ownership shares, voting rights, and control structures.

Steps

-

Gather BOI for Each Ownership Layer

Gather comprehensive information on all entities and individuals holding direct or indirect ownership in the entity under review. This includes shareholders, members, and other stakeholders who exert control through equity holdings, voting rights, or contractual agreements. Identifying beneficial owners requires analyzing corporate structures, ownership chains, and financial arrangements to trace individuals who ultimately influence decision-making. Additionally, assess nominee arrangements, trusts, and subsidiaries that may obscure true ownership. Ensuring accurate and up-to-date beneficial ownership records enhances transparency, regulatory compliance, and risk assessment while mitigating exposure to financial crimes such as money laundering, fraud, and tax evasion.

-

Analyzing Ownership and Control Details:

Analyze ownership percentages, voting rights, and control mechanisms to identify individuals or entities with significant influence over the company. This process involves reviewing company records, shareholder agreements, board structures, and contractual arrangements that dictate decision-making authority. Additionally, assess any special voting rights, nominee structures, or indirect control mechanisms that may impact governance. Thorough documentation analysis ensures transparency, regulatory compliance, and a clear understanding of the entity’s ultimate beneficial ownership (UBO) structure.

-

Identifying Natural Persons with Significant Control:

- Identify the natural persons who ultimately control the entity, considering both direct and indirect ownership stakes. Regulatory standards typically establish a threshold for ownership or control.

- In this case, we’ve applied a 25% threshold for beneficial ownership and include individuals with operational control, voting rights, or other significant influence as UBOs.

- Factors include:

- Ownership Shares: Direct and indirect ownership percentages (equity holdings).

- Voting Rights: The ability to influence decisions through voting power.

- Control Mechanisms: Board seats and representation, veto powers, contractual agreements and other forms of control.

Person 1: 50% ownership of Entity A (25% indirect ownership of XYZ Ltd.), 45% voting rights in Entity A, and a board seat.

Person 2: 20% of Entity A (10% indirect ownership of XYZ Ltd.) and veto power.

Person 3: 100% of Entity C (15% indirect ownership of XYZ Ltd.).

Person 4: 60% of Entity D (30% indirect ownership of XYZ Ltd.), with significant operational control.

Person 5: 100% of Entity E (20% indirect ownership of XYZ Ltd.).

UBOs Identified

- Person 1: Due to ownership percentage and a board seat.

- Person 2: Due to veto power.

- Person 4: Due to ownership percentage and operational control.

Notice: Despite having only 10% indirect ownership in XYZ Ltd.

P2 has veto power on major decisions within Entity A. This veto power grants P2 significant influence over Entity A’s decisions, including those affecting XYZ Ltd. Regulatory frameworks often recognize control mechanisms, such as veto power, as significant indicators of beneficial ownership. Veto power allows P2 to influence or block major decisions, giving them substantial control over the entity.

Future Trends and Regulatory Updates

As corporate transparency and financial regulations evolve, upcoming changes will significantly impact Ultimate Beneficial Ownership (UBO) frameworks. Governments and regulatory bodies worldwide are enhancing disclosure requirements to combat money laundering, fraud, and tax evasion. Compliance officers, legal professionals, and businesses must stay informed about these developments to ensure adherence to new laws and avoid regulatory penalties. Increased scrutiny, stricter reporting obligations, and technological advancements in compliance monitoring are shaping the future of UBO regulations. Proactive adaptation to these trends is essential for maintaining transparency, mitigating financial crime risks, and ensuring continued compliance in an increasingly regulated global financial landscape.

Emerging Trends in UBO Regulations

Increased Global Cooperation:

International organizations and governments are strengthening cooperation to standardize UBO regulations, fostering a unified approach to combating financial crimes. Greater cross-border information sharing and coordinated enforcement efforts are expected to close regulatory loopholes, making it harder for criminals to hide illicit activities. As jurisdictions align their transparency standards, businesses must adapt to evolving compliance requirements to mitigate risks. This global push toward harmonization enhances accountability, reduces financial crime opportunities, and ensures more effective oversight of beneficial ownership structures worldwide.

Technology and Digital Solutions:

The integration of blockchain, artificial intelligence (AI), and machine learning is revolutionizing UBO data collection, verification, and monitoring. These technologies enhance accuracy, minimize human error, and enable real-time oversight of beneficial ownership structures. By automating compliance processes, they strengthen financial transparency and improve regulatory efficiency in detecting and preventing illicit financial activities.

Expansion of Reporting Requirements:

Many jurisdictions are strengthening UBO reporting requirements, extending them to a wider range of entities, including trusts, partnerships, and complex ownership structures. Businesses must adapt their compliance processes to meet stricter and more comprehensive disclosure obligations, ensuring transparency and regulatory adherence to prevent financial crimes and enhance oversight of corporate ownership.

Public Access vs. Privacy Balance:

Regulatory debates continue over balancing UBO transparency and privacy rights. Some jurisdictions are implementing safeguards to protect personal data while maintaining disclosure requirements. New measures may refine how UBO information is accessed, ensuring regulatory compliance while addressing concerns over data protection and financial transparency.

Upcoming Regulatory Changes by Region

United States:

Recent developments surrounding the Corporate Transparency Act (CTA) have led to significant changes in reporting requirements and compliance deadlines. Initially, the CTA mandated that existing companies formed before January 1, 2024, submit their Beneficial Ownership Information Reports (BOIR) by January 1, 2025, while new entities created after this date were required to file within 90 days of their formation.

However, legal challenges temporarily halted the enforcement of these requirements. A federal judge in Texas issued an injunction, questioning the constitutionality of the CTA. This decision was subsequently stayed by the U.S. Supreme Court, allowing the enforcement of the CTA to proceed. In light of these legal proceedings, the Financial Crimes Enforcement Network (FinCEN) has extended the filing deadline. Most companies are now required to submit their Beneficial Ownership Information Report (BOIR) by March 21, 2025.

Non-compliance with the CTA carries substantial penalties. Civil fines can amount to $591 per day of continued violation, adjusted for inflation, while criminal penalties may include fines up to $10,000 and imprisonment for up to two years. These developments underscore the importance for businesses to stay informed and ensure timely compliance with the evolving requirements of the CTA.

European Union:

The European Union’s 6th Anti-Money Laundering Directive (6AMLD), effective since December 2020, aims to strengthen the fight against financial crime by harmonizing offenses and penalties across member states. Key enhancements include an expanded definition of money laundering offenses, extended criminal liability to legal entities, and a minimum imprisonment term of four years for serious offenses. Looking ahead, the EU is progressing towards the 7th Anti-Money Laundering Directive (7AMLD), which seeks to further refine and enhance existing regulations, ensuring they remain robust against evolving financial crime tactics.

United Kingdom:

Post-Brexit, the UK is strengthening its People with Significant Control (PSC) regime to enhance corporate transparency and align with evolving international standards. Recent legislative developments, particularly the Economic Crime and Corporate Transparency Act 2023 (ECCT Act), have introduced significant changes to disclosure requirements, verification processes, and enforcement measures.

The ECCT Act mandates that overseas entities holding UK property as nominees must now disclose their registrable beneficial owners, including details of any legal entities acting as trustees within the ownership chain. This initiative aims to prevent the concealment of true ownership through complex structures. Additionally, to improve the accuracy of PSC information, the UK government is enforcing stricter identity verification requirements. Individuals and nominated managing officers associated with entities are now subject to verification processes, ensuring the reliability of the data submitted to Companies House.

Enforcement measures have also been strengthened under the new regulations. Regulatory bodies have been granted increased authority to ensure compliance, with significant penalties for non-compliance. Entities failing to meet the new disclosure and verification standards may face restrictions on property transactions and potential criminal charges for persistent violations. These reforms reaffirm the UK’s commitment to financial transparency and corporate accountability, ensuring that beneficial ownership information remains accurate and accessible.

Preparing for the Future

To stay ahead of these trends and regulatory changes, businesses should:

- Monitor Regulatory Developments: Continuously track updates from regulatory authorities and international organizations to ensure compliance with evolving standards.

- Strength Compliance Framework: Regularly update compliance programs to align with new regulations, incorporating best practices to mitigate risks effectively.

- Engage with Expert Guidance: Collaborate with legal and compliance professionals to navigate regulatory complexities and understand the implications of emerging requirements.