Freight Factoring

Truck Owners and Drivers Association freight factoring for Truckers, the supportive to growth and fastest way to get paid.

Get Paid Faster with Factoring!

The wait for freight payments can be a major pain point for truck owners and operators. You deliver the load, get the signed invoice, but then... silence. Payments can take weeks, even months, to arrive, while your bills and expenses pile up.

Don't let slow payments hold you back! Contact Truck Owners and Drivers Association today to learn more about factoring and take control of your cash flow.

Together, let's keep America's trucks rolling!

Factoring

Benefits of Factoring for Truck Owners and Operators

Let’s start the journey towards success and enhance revenue for your business. Take your company to the next level.

Faster access to cash

No more waiting for slow payments. Get paid within days of delivery.

Improved cash flow

Pay bills, cover fuel costs, and invest in your business without waiting for invoices to clear.

Reduced financial stress

Focus on the road, knowing your cash flow is secure.

Simplified paperwork

Factoring companies handle the collection process, saving you time and resources.

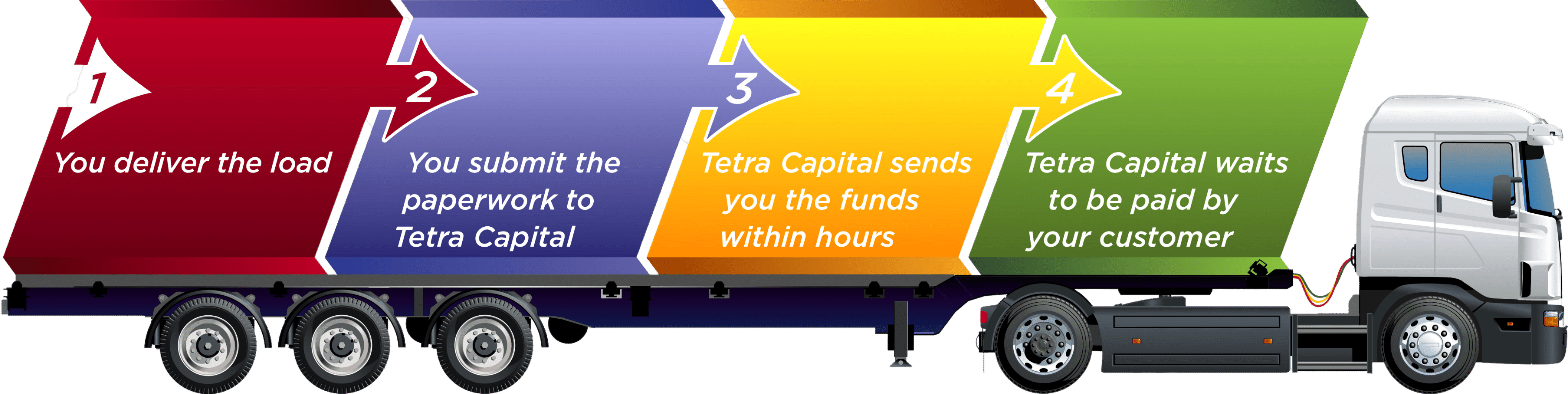

What Are the Steps of the Factoring Process?

- The trucking company or owner-operator starts factoring with a factoring company.

- The trucking company notifies their customers about the factoring arrangement. Most customers are accustomed to the factoring arrangement as it is quite common in the industry.

- Driver transports the load for the customer, makes the delivery and receives a signed invoice.

- The driver then sends a copy of the invoice to the factoring company.

- The factoring company must verify the invoice to ensure the load has been delivered according to the terms of the contract.

- The factoring company advances the driver a percentage of the invoice’s value within a few days of receiving the invoice.

- The driver can receive up to 98% of the original value of the invoice.

- The factoring company takes over the billing process and collects from the customer.

What Are the Steps of the Factoring Process?

by Truck Owner and Drivers Association

- The trucking company or owner-operator starts factoring with a factoring company.

- The trucking company notifies their customers about the factoring arrangement. Most customers are accustomed to the factoring arrangement as it is quite common in the industry.

- Driver transports the load for the customer, makes the delivery and receives a signed invoice.

- The driver then sends a copy of the invoice to the factoring company.

- The factoring company must verify the invoice to ensure the load has been delivered according to the terms of the contract.

- The factoring company advances the driver a percentage of the invoice’s value within a few days of receiving the invoice.

- The driver can receive up to 98% of the original value of the invoice.

- The factoring company takes over the billing process and collects from the customer.

Recourse vs Non-recourse Factoring

One set of terms you’ll run into if you choose to call upon the services of a factoring are recourse and non-recourse factoring. Knowing the difference between the two will impact how much you stand to gain, or potentially lose if you decide to use a factoring company. Let’s take a look:

Recourse Factoring

Companies that offer recourse factoring take a lower percentage cut which means more money in your pocket. But there’s a catch. If they are unable to collect payment from your customer, you are required to buy back the invoice. That’s a bad situation to be in when you have cash flow to maintain. And chances are, if the factoring company couldn’t collect on the invoice, you’re going to be left unpaid for the load for no telling how long.

Non-recourse Factoring

Companies that offer non-recourse factoring seem like pretty nice guys compared to the alternative. With this type of factoring if the customer doesn’t pay, you won’t be held liable for repaying the invoice. Again, there is a catch. With non-recourse, the factoring company takes a substantially larger cut of the invoice’s value. That leads to a smaller pile of cash for you but a little less is better than the “you have to pay us the entire amount back” prospect offered with recourse factoring.

Why Do Companies Use Factoring?

Many companies use factoring because, in the trucking business, you need your cash flow to operate today, not three months from now. The small percentage of load value you give up in exchange for faster payment is just a small price compared to all other business-related costs to cover.

Do I Need a Factoring Company To Be Successful As An Owner-Operator?

You can run your trucking business perfectly fine without the services of a factoring company. Of course, you will have to plan for the lengthy wait times on getting paid by your customers, but you won’t be out the fees and percentage cut taken by a factoring company. Ultimately, factoring is a quality-of-life upgrade for a price, and many owner-operators have successfully used factoring.

At TODA (Truck Owners and Drivers Association), we understand you want to get paid quickly for your deliveries. While factoring companies offer an option, they come with fees and take a percentage of your hard-earned money. You will receive instant payments for a much smaller fee than any factoring company. In addition, owner-operators receive additional perks such as:

Instant Payments: No more waiting! Get paid immediately after completing a delivery.

Lower Fees: Save money compared to traditional factoring companies.

More Than Just Payments: CloudTrucks offers a comprehensive suite of benefits to empower your trucking business, including:

Step into the future of trucking and sign up with Truck Owners and Drivers Association today.

What Say Our Members!

Client testimonials demonstrate why numerous transportation professionals opt for the Truck Owners and Drivers Association Factoring Process.

TODA's factoring process is smooth and efficient. I get paid fast, which keeps my cash flow healthy and allows me to focus on the road.

Arkansas

The fees are transparent and competitive. Plus, TODA's team is always available to answer my questions and guide me through the process.

Winston Salem, NC

With TODA handling my factoring, I don't have to chase down slow payments from clients. It's a lifesaver!

Black Mountian, N.C

Just like this glowing review about a service that saves time, reduces stress, and ensures things are done correctly, factoring offers similar benefits for your trucking business.

Richard Esser, LLC

Orlando, FL