ALERT [updated Feb. 19, 2025]: Beneficial ownership reporting requirements are back in effect, with a new deadline of March 21, 2025 for most companies.

ALERT [updated Feb. 19, 2025]: Beneficial ownership reporting requirements are back in effect, with a new deadline of March 21, 2025 for most companies.

Financial Crimes Enforcement Network

Corporate Transparency Act 2021

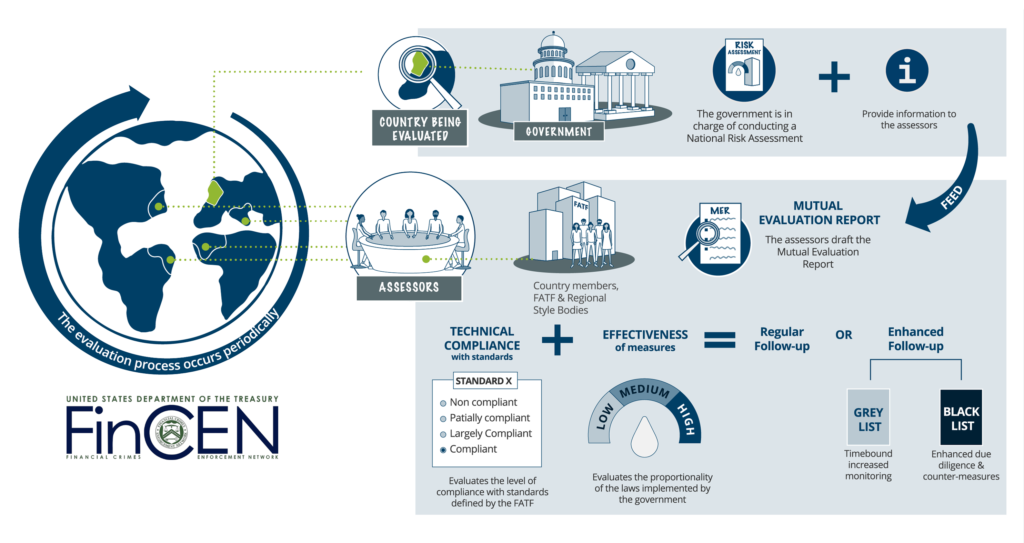

The Financial Action Task Force (FATF), aka Groupe d’action financière International (GAFI), is an intergovernmental organization established in 1989 by the G7 nations to develop policies aimed at combating money laundering and tax evasions. Following the events of September 11, 2001, its mandate expanded to include efforts against terrorism financing. The FATF sets international standards and promotes the effective implementation of legal, regulatory, and operational measures to protect the global financial system’s integrity. Beneficial Ownership Information is one of the measures enacted globally by the member countries…

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) plays a pivotal role in implementing FATF’s recommendations within the United States. FinCEN serves as the nation’s financial intelligence unit, collecting and analyzing information about financial transactions to combat domestic and international money laundering, tax evasion, terrorist financing, and other financial crimes. By aligning with FATF standards, FinCEN ensures that the U.S. financial system remains robust against illicit activities.

Panama Papers

Revealed records from the Panamanian law firm Mossack Fonseca

Exposed financial dealings of wealthy and powerful individuals, including government officials, royalty, and entertainers

Revealed how individuals, companies, and political leaders created shell companies to hide assets, avoid taxes, and launder money

Paradise Papers

Revealed the widespread use of illicit offshore tax havens by government officials, royalty, entertainers, and powerful corporations

Included documents from the offshore law firm Appleby, as well as business registries in Bermuda, the Cayman Islands, Lebanon, and Malta

Included documents that linked Aliko Dangote, then Africa’s richest man, to shell companies in tax havens

Beneficial Ownership Information (BOI) reporting and the establishment of similar registers worldwide are crucial tools in combating financial crimes. By requiring entities to disclose individuals who directly or indirectly own or control them, authorities can pierce the veil of anonymity that criminals often exploit. This transparency deters the misuse of corporate structures for illicit purposes and strengthens the overall integrity of the financial system.

Enacted in 2021, the Corporate Transparency Act (CTA) addresses the challenges posed by anonymous shell companies that can facilitate money laundering, tax evasion, and other illicit activities. The CTA mandates that certain business entities disclose their Beneficial Ownership Information to FinCEN, thereby enhancing transparency and aiding law enforcement agencies in tracking illicit financial flows.

For small businesses, these measures can lead to a more equitable economic environment. While there have been concerns about regulatory burdens, transparency initiatives can enhance trust in the marketplace, attract legitimate investment, and ensure a level playing field where all entities operate under the same rules. However, it’s essential to balance transparency efforts with considerations of the compliance costs for smaller entities. Recent developments indicate ongoing debates about the enforcement of such regulations, highlighting the need for policies that safeguard against financial crimes without imposing undue burdens on small businesses.

In summary, organizations like the FATF and FinCEN, along with legislative measures like the CTA of United States, play integral roles in promoting financial transparency. Such initiatives are vital in preventing tax evasions, financial crimes, fostering trust, and ensuring the stability and integrity of economic systems, benefiting businesses of all sizes.

What is Beneficial Ownership Information?

A Comprehensive Guide to BOIR

If you’ve been following recent financial compliance news, you may have encountered the term “Beneficial Ownership Information Report” (BOIR). This report is a key component of the Corporate Transparency Act (CTA), enacted in 2021 to enhance transparency and combat illicit activities such as money laundering and tax evasion.

What is a Beneficial Ownership Information Report (BOIR)?

A BOIR is a formal regulatory filing that discloses the identities of a company’s beneficial owners—the individuals who ultimately own or control a business entity. The report aims to unveil the real individuals behind corporate structures, assisting governmental agencies and financial institutions in combating financial crimes like money laundering, tax evasion, and terrorist financing.

Under the CTA, the Financial Crimes Enforcement Network is responsible for maintaining a secure database of these records, ensuring a traceable record of who truly controls and benefits from any given company.

Why Was the BOIR Introduced?

The CTA and the subsequent ‘Beneficial Ownership Information’ requirement emerged to address the growing need for transparency in global financial systems. Illicit actors often hide behind shell companies and complex corporate structures to mask their true identities and facilitate illegal activities. By requiring a BOIR, regulators aim to:

- Enhance Financial Transparency: Making beneficial ownership data more accessible to authorized parties reduces opportunities for bad actors to misuse corporate structures.

- Prevent Illicit Activities: With clear records of ownership, law enforcement agencies can more easily track and prevent financial crimes.

- Strengthen Global Reputation: A transparent and accountable environment fosters trust among investors, business partners, and consumers, bolstering the credibility of the U.S. market.

Who Needs to File a BOIR?

While exemptions exist, most domestic and foreign entities doing business in the U.S. are subject to Beneficial Ownership Information Reporting (BOIR) requirements. This typically includes:

- Corporations: Traditional for-profit corporations formed under U.S. state laws.

- Limited Liability Companies (LLCs): Both single-member and multi-member LLCs must comply.

- Other Similar Entities: Limited partnerships, limited liability partnerships, and other statutory entities formed in the U.S. or registered to do business here often need to file as well.

How a Beneficial Owners is Defined?

Beneficial owners typically include individuals who:

- Own at Least 25% of the Company: Anyone holding a substantial equity stake.

- Exercise Significant Control: Those who have meaningful influence over the company’s decisions, such as executive officers or directors with extensive voting rights.

What Information Does the BOIR Include?

The BOIR must contain accurate, up-to-date details on each beneficial owner, including:

- Full Legal Name

- Date of Birth

- Current Residential or Business Address

- Government-Issued Identification Number and Issuing Jurisdiction

This ensures that law enforcement, regulatory bodies, and financial institutions can verify identities and conduct due diligence.

What is the Current Filing Deadlines?

- Reporting Companies Created or Registered Before January 1, 2024: The initial deadline to file BOIRs was January 1, 2025. However, due to recent legal developments, FinCEN has extended this deadline to March 21, 2025.

- Reporting Companies Created or Registered On or After January 1, 2024: Initially, these entities were required to file BOIRs within 30 days of their creation or registration. Recognizing the need for additional time to understand and comply with the new requirements, FinCEN extended this filing period to 90 days for entities created or registered between January 1, 2024, and January 1, 2025. Entities formed on or after January 1, 2025, are required to file their BOIRs within 30 days of notice of their creation or registration.

How to File Your BOIR?

Most businesses will file their BOIR electronically through FinCEN’s secure online platform. Before filing, compile all necessary identification documents and verify all beneficial owner details for accuracy. Consulting with a legal or compliance expert can also help ensure that you meet all requirements on your first attempt.

Staying Compliant and Informed

Given the evolving nature of these regulations, it’s essential for businesses to stay informed about their compliance obligations. Regularly consulting official sources such as FinCEN and the U.S. Department of the Treasury, as well as seeking guidance from legal and financial professionals, can help ensure that your business remains compliant with any future reporting requirements.

In Conclusion

The Beneficial Ownership Information Report is more than just another regulatory requirement—it’s a cornerstone of the U.S. government’s effort to promote transparency, prevent fraud, and maintain a trustworthy business environment. By understanding what the BOIR is, who needs to file, and how to remain compliant, you can protect your business from legal pitfalls and build a foundation of trust with customers, investors, and regulatory authorities.

Next Steps:

- Evaluate your company’s beneficial ownership structure.

- Stay updated on regulatory developments.

- Consult with a compliance professional to ensure a smooth reporting process.

- Embrace the BOIR as an opportunity to improve your organization’s transparency and credibility in today’s highly scrutinized financial landscape.

Who Needs to File Beneficial Ownership Information?

An Understanding of BOIR

The Corporate Transparency Act (CTA) mandates that many U.S. businesses submit Beneficial Ownership Information (BOI) reports to the Financial Crimes Enforcement Network (FinCEN). These reports aim to enhance transparency and combat illicit financial activities by identifying individuals who own or control business entities.

Who Must File a BOI Report?

Under the CTA, a “reporting company” is defined as a corporation, limited liability company (LLC), or other similar entity that is created or registered to do business in the U.S. by filing a document with a secretary of state or comparable office.

- Corporations: Both C-corporations and S-corporations formed under U.S. state law.

- Limited Liability Companies (LLCs): Single-member and multi-member LLCs formed or registered in the U.S.

- Other Similar Entities: Limited liability partnerships (LLPs), limited partnerships (LPs), and certain statutory trusts.

- Foreign Entities Registered in the U.S.: Foreign-based entities authorized to do business within the United States.

Who is Exempt from Filing BOI Reports?

Certain entities are exempt from filing BOI reports, including:

- Banks and Credit Unions: Already subject to rigorous reporting requirements.

- Publicly Traded Companies: Companies listed on U.S. stock exchanges with disclosures overseen by the Securities and Exchange Commission (SEC).

- Nonprofit Organizations: Many charitable and nonprofit entities may be exempt.

What are the Criteria for the Inactive Entity Exemption?

An entity qualifies for the inactive entity exemption if all six of the following criteria are met

- The entity was in existence on or before January 1, 2020.

- The entity is not engaged in active business.

- The entity is not owned by a foreign person, whether directly or indirectly, wholly or partially. “Foreign person” means a person who is not a United States person. A “United States person” is defined in section 7701(a)(30) of the Internal Revenue Code of 1986 as: a citizen or resident of the United States; domestic partnership; a domestic corporation; and certain estates and trusts.

- The entity has not experienced any change in ownership in the preceding twelve-month period.

- The entity has not sent or received any funds in an amount greater than $1,000, either directly or through any financial account in which the entity or any affiliate of the entity had an interest, in the preceding twelve-month period.

- The entity does not otherwise hold any kind or type of assets, whether in the United States or abroad, including any ownership interest in any corporation, limited liability company, or other similar entity.

What are the Key Compliance Deadlines?

As of February 19, 2025, FinCEN extended the BOI reporting deadline by 30 days, making the new deadline March 21, 2025, for most companies.

- Reporting Companies Created or Registered Before Feb 20, 2025: The deadline to file BOIR’s is March 21, 2025.

How to Staying Compliant with BOI Reporting?

To ensure compliance:

- Conduct an Ownership Audit: Identify all beneficial owners and confirm each owner’s personal information.

- Prepare Documentation: Gather required identification documents, such as driver’s licenses, passports, or other government-issued IDs for beneficial owners.

- Consult Experts: Work with an attorney or compliance professional to fully understand the requirements and filing process.

- Use Compliance Tools: Consider software solutions designed for beneficial ownership tracking to streamline data collection and simplify reporting to FinCEN.

In Conclusion

The BOI reporting requirement affects a broad range of U.S. and foreign entities operating in the United States. If you’re unsure whether your company needs to file, seek professional guidance. By confirming your entity’s status and understanding who qualifies as a beneficial owner, you can avoid noncompliance, uphold transparency, and protect your company’s reputation.

Next Steps:

- Determine Eligibility: Review your entity type, ownership structure, and operations to confirm whether you must file.

- Gather Information: Start collecting the necessary documents and data well before the deadline.

- Stay Informed: Keep an eye on industry news for any updates to BOI reporting requirements.

How to File Beneficial Ownership Information Report?

Step-by-Step Guide to BOIR Filing

Filing your Beneficial Ownership Information Report (BOIR) is a crucial step in complying with the Corporate Transparency Act (CTA), which aims to enhance transparency in business ownership and combat illicit financial activities. Follow this step-by-step guide to ensure a smooth filing process:

Step 1: Determine If You Need to File

Identify whether your business qualifies as a “Reporting Company” under the CTA. This includes corporations, limited liability companies (LLCs), and similar entities that are:

- Created or Registered Before January 1, 2024: These entities must file their initial BOIR by March 21, 2025.

- Created or Registered On or After January 1, 2024: These entities are required to file their BOIR within 30 days of their formation or registration.

Certain entities are exempt from filing, such as publicly traded companies and specific regulated entities.

Step 2: Gather Required Information

Collect detailed information about each beneficial owner of your business. A beneficial owner is an individual who:

- Directly or Indirectly Owns 25% or More of the Company: Holds a substantial equity interest.

- Exercises Significant Control Over the Company: Has substantial influence over company decisions.

The required information for each beneficial owner includes:

- Full Legal Name

- Date of Birth

- Residential or Business Address

- Unique Identifying Number: From an acceptable identification document (e.g., passport, driver’s license)

Ensure you have electronic images of the identification documents ready for upload.

Step 3: Access the Filing Portal

Visit BOIR E-Filing System to begin the filing process. The portal supports electronic submission of the Beneficial Ownership Information Report (BOIR).

Step 4: Complete the Online Form

Fill out the Online BOIR Form with required details of Reporting Company and Beneficial Owner. Upload image file of your ID. Field marked with red asterisk are required.

Step 5: Complete and Submit Your Report

Once the Online BOIR Form is completed, review all entered information before submitting the report.

Conclusion

After submission, you will receive a confirmation from FinCEN. Retain this confirmation for your records.

What are the Penalties for Non-Compliance?

Understanding Fines and Penalties

Financial Crimes Enforcement Network is working hard to ensure that reporting companies are aware of their obligations to report, update and correct Beneficial Ownership Information Report (BOIR), which is a key component of the Corporate Transparency Act (CTA), designed to enhance transparency in business ownership and combat illicit financial activities. Non-compliance, including but not limited to non-filing, incorrect filing, or omission of BOIR requirements can lead to significant penalties, including substantial civil and criminal penalties with imprisonment.

What Types of Penalties Apply for BOIR Non-Compliance?

- Civil Penalties:

- As, specified in Corporate Transparency Act, failure to file a BOIR or submitting incomplete or incorrect information may be subject to Civil fines of up to $591 for each day that the violation continues. This Civil penalty amount is adjusted annually for inflation. As of the publication of this FAQ the amount is $591 accrued daily

- Criminal Penalties:

- A person who willful violates the BOI reporting requirements may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000. Potential violations include willfully failing to file a beneficial ownership information report, willfully filing false beneficial ownership information, or willfully failing to correct or update previously reported beneficial ownership information within 90 days.

Recommendations to Avoid Future Penalties

- Stay Informed: Regularly monitor updates from the Treasury Department and Financial Crimes Enforcement Network regarding BOIR requirements and enforcement policies.

- Conduct Regular Ownership Audits: Keeping an updated record of all beneficial owners ensures that you have the necessary data ready well before filing deadlines. Regularly reviewing ownership changes and verifying personal information can help you maintain compliance effortlessly.

- Consult Professionals: Engage legal and compliance experts to navigate the evolving regulatory landscape effectively.

By proactively managing compliance efforts, businesses can mitigate risks associated with BOIR non-compliance and adapt to future regulatory changes.